myitreturn.com – How To Login Into MyITreturn Account

Login Tutorial

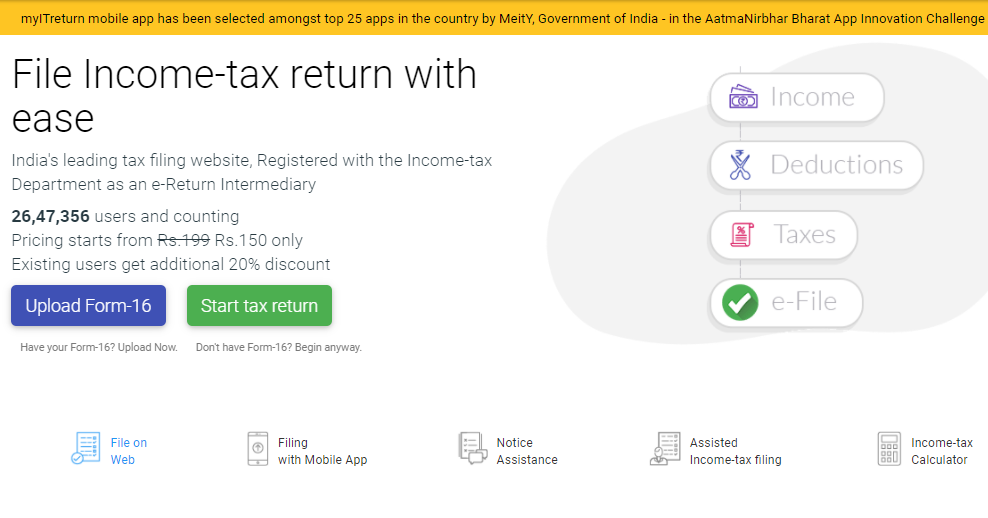

MyITreturn Overview

myITreturn has clients from everywhere in the country and numerous from outside India who like to utilize the site to record their government form easily. It is an undertaking based on the plan to make the always expanding charge documenting cerebral pain a relic of past times. The site is extremely simple and instinctive to utilize.

About MyITreturn:

- They have built up the pilot Return Preparation Utility for GST pilot. This was created to test the GST pilot framework.

- They have prior given programming projects to experts identifying with Fringe Benefits Tax and Banking Cash Transaction Tax. Both these expense forms are presently nullified.

MyITreturn Login:

- To login open the webpage myitreturn.com

- After the page appears at the top right click on the ‘Sign in’ button.

- In the next screen provide account associated email, password now hit on ‘Login’ button.

- You can log in with Facebook or Google accounts.

How to Reset MyITreturn Login Credentials:

- To reset the login details open the page myitreturn.com

- As the page appears on the login homepage hit on the ‘Forgot password?’ button.

- In the next screen select the profile and provide the corresponding value now hit on ‘search’ button.

Register for MyITreturn Account:

- To register for the account open the page myitreturn.com

- Once the page appears on the login homepage hit on the ‘New user’ button.

- You have to provide an email, mobile number, set the password, enter the verification code hit on ‘Start’ button.

Important Information on ITR-V E-Verification Code:

- EVC of ITR Through Net Banking: Only a modest bunch of banks in the nation offer this assistance. You can log in to your net financial record and search for e-check choices. From that point, you can produce a 10-digit alpha-numeric number or the electronic confirmation code (EVC). There are a few situations where an individual citizen in the nation can in any case decide to record their profits utilizing the paper mode. Initially, on the off chance that you are a senior resident, over 80 years of age or on the off chance that you are a little citizen whose yearly pay doesn’t surpass INR 5,00,000 and you are not expecting any duty discounts for a financial year.

- EVC of ITR Through Your Ledger: Even this office is accessible just with a small bunch of banks. You need to pre-approve your ledger number, post which you can create EVC. A few years earlier, the best way to check your government form was to take a printout of the affirmation structure sent by the annual duty division, sign the frame and send it to the Centralized Processing Center situated in Bengaluru.

- Confirm by Means of Demat Account: This strategy is somewhat like check through ledgers. You need to pre-check your de-mat account number post which you can produce EVC. This affirms that the annual expense office has gotten your profits and anticipates that you should confirm the equivalent. The check step guarantees that you know that a government form is being documented for your benefit and you confirm the equivalent.

- Check Through ATM: The personal duty division has given authorization to just six banks to offer such administrations. You can visit their ATMs and utilize the ‘pin for e-documenting choice’. This will permit you to produce an EVC. For every other person, documenting assessment forms should be done electronically. Be that as it may, your expense recording isn’t viewed as complete by just documenting your profits.

- Aadhar Card Check: Alternatively, you can confirm your profits with the assistance of your Aadhar card and OTP service. It is imperative to take note that the EVC created is an extraordinary number and is related to your PAN. Also, there must be one EVC for a PAN. On the off chance that your return requires any alterations or amendments, you should create another EVC for return.

Read More : Login To Your Cox Account

MyITreturn Customer Help:

To get more help call on the toll-free number 1800 103 4455. +91-80-46605200.

Reference Link: